Taxation

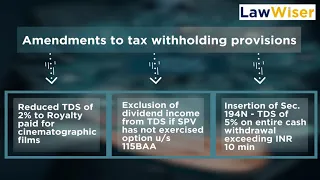

Taxation is a complex and crucial practice area for Indian enterprises. It includes compliance difficulties, tax structure, GST, and representation before tax authorities, tribunals, high courts, and the Supreme Court of India. Businesses must traverse a complicated web of tax laws and regulations to ensure compliance with applicable tax laws and prevent any negative consequences. Tax law is always changing, and being up to date on the newest developments and changes is critical to ensuring compliance and avoiding legal complications.Taxation attorneys assist businesses in understanding tax rules and regulations, complying with them, and providing representation in the event of a dispute or lawsuit. They assist firms in navigating India’s complex tax environment by utilizing their expertise in taxation law and experience interacting with tax officials. A knowledgeable taxation lawyer is a valuable asset for businesses in ensuring compliance with tax rules and regulations and avoiding any legal complications that may occur as a result of noncompliance. LawWiser provides simplified legal content on taxation that covers a wide range of direct and indirect taxation subjects. Our platform comprises top legal professionals who answer Frequently Asked Questions and handle regularly presented difficulties, all while emphasizing the impact of taxation on businesses. We seek to provide concise explanations of complicated rules and regulations through our videos, making it easier for businesses to handle the crucial component of taxes compliance. Explore our videos on topics such as the Income Tax Act, input tax credit, carbon tax, GST and GST Council updates, and PLI schemes to stay up to date on the newest developments in taxation. You can improve your legal knowledge and acquire useful insights into the ever-changing world of taxation by tuning into this section of LawWiser.